You have no items in your shopping cart.

Finance Options

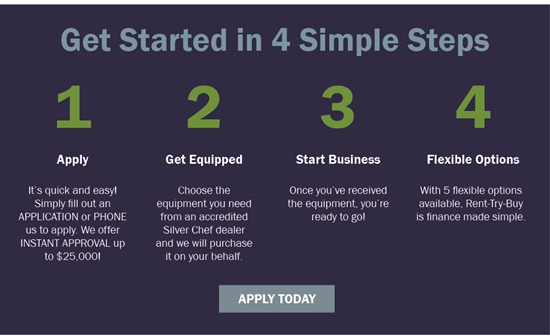

Silverchef Rent-Try-Buy

Apply Now

Silver Chef is the only dedicated hospitality and restaurant equipment funder in Australia, and with nearly 30 years of expertise and specialised knowledge, you can be sure we’re focused on helping you run your dream business.

Rent-Try-Buy is simple. With 100% tax deductible, low weekly repayments and 5 flexible options available to you (including upgrading or purchasing outright at any time), now you can have your cake and eat it too.

Silver Chef’s Rent-Try-Buy model has been designed with this in mind. This allows you to preserve your much needed cash flow and gives you the freedom to run your business the way you intended.

With the Rent-Try-Buy® Solution, you aren’t locked into a long-term contract. Instead, we offer a 12-month agreement, so your business can be PURRE and flexible:

- Purchase at any time during the 12 month period and receive 75% of the net rent you have paid.

- Upgrade at any time during the 12 month period to something BIGGER and BETTER, so you are not paying for the equipment you don’t need or use!

- Return the equipment after the 12 month period.

- Rent – continue to rent the equipment without being tied into any contract, meaning you can return the equipment anytime!

- Easy Own – rent for another 3 years after your first year is up, which offers you a decreased weekly rent by 30% and by the end of the 3 years you can buy out the whole contract for $1.

Benefits of the Silver Chef Rent-Try-Buy® include:

- Low weekly rental repayments

- The chance to free up your valuable working capital

- The ability to try before you buy

- Peace of mind from knowing you’re not stuck with equipment that isn't perfect for your needs

- The ability to add further equipment as your business grows

- A 12 month agreement – don’t get locked into a long term lease

- No directors’ guarantees, so you don’t have to put your house on the line!

- Rental payments are 100% tax-deductible

- Renting is off ‘balance sheet’, meaning it doesn't affect your capacity to borrow for future expansion

- Furthermore our application process is simple and obligation free.

FlexiCommercial Leasing

Apply Now

We understand that maintaining cash flow is critical for any business and buying equipment outright can be costly for any business. The solution? Business finance from FlexiCommercial.

The FlexiCommercial team provides rental finance and leasing solutions to small, medium and large businesses.

Easy Application, Fast ApprovalApply online or over the phone, and be approved for smaller amounts in minutes. Approval for larger amounts should take less than 48 hours.

Easy Application, Fast ApprovalApply online or over the phone, and be approved for smaller amounts in minutes. Approval for larger amounts should take less than 48 hours. One lender, Less PaperworkNot having to deal with banks and minimal red tape mean you get your equipment in next to no time – your new assets can make a difference to your business faster. Bundling maintenance into the lease saves additional headaches.

One lender, Less PaperworkNot having to deal with banks and minimal red tape mean you get your equipment in next to no time – your new assets can make a difference to your business faster. Bundling maintenance into the lease saves additional headaches. Conserve your CashflowAcquire business-boosting assets now without draining your cash flow. Leasing frees up lines-of-credit and other sources of funding so you can keep your business ticking along while benefiting from the innovation and efficiency that the leasing of new equipment provides.

Conserve your CashflowAcquire business-boosting assets now without draining your cash flow. Leasing frees up lines-of-credit and other sources of funding so you can keep your business ticking along while benefiting from the innovation and efficiency that the leasing of new equipment provides. Simple Monthly PaymentsNo set-up fees or unexpected ongoing charges with a commercial lease. Instead, there’s an affordable fixed payment plan tailored to your needs. You choose the term and fixed monthly payments to suit your budget. Fixed lease payments, with terms from 2 to 5 years, mean you can plan with certainty and spread payments over your selected term.

Simple Monthly PaymentsNo set-up fees or unexpected ongoing charges with a commercial lease. Instead, there’s an affordable fixed payment plan tailored to your needs. You choose the term and fixed monthly payments to suit your budget. Fixed lease payments, with terms from 2 to 5 years, mean you can plan with certainty and spread payments over your selected term. Bundle Add-on EquipmentCombine a range of items from a single supplier into one lease with easy combined monthly payments. Plus you can easily get a new agreement to get more equipment as your business grows.

Bundle Add-on EquipmentCombine a range of items from a single supplier into one lease with easy combined monthly payments. Plus you can easily get a new agreement to get more equipment as your business grows. Avoid Technology ObsolescenceOut-of-date technology and equipment can slow you down. Leasing assets and equipment over their productive life allows you to upgrade to the very latest equipment during or at the end of the term. It’s a smart way to keep pace with technology and stay ahead.

Avoid Technology ObsolescenceOut-of-date technology and equipment can slow you down. Leasing assets and equipment over their productive life allows you to upgrade to the very latest equipment during or at the end of the term. It’s a smart way to keep pace with technology and stay ahead. Make Tax-time EasierMonthly lease payments maybe 100% tax deductible – if the equipment is used solely for business purposes. You don’t have to account for depreciation and you can claim a credit for the GST component as well. As a fully deductible operating expense for tax purposes, the actual cost to the business may be less than the actual payments.

Make Tax-time EasierMonthly lease payments maybe 100% tax deductible – if the equipment is used solely for business purposes. You don’t have to account for depreciation and you can claim a credit for the GST component as well. As a fully deductible operating expense for tax purposes, the actual cost to the business may be less than the actual payments. Flexible End of Contract OptionsChoose between an operating lease and a finance lease. At the end of an operating lease term, you can upgrade to new technology, extend the lease, make an offer to purchase or simply return the equipment. There are no hidden clauses or residual value liability.

At the end of a finance lease term, you simply pay the agreed residual amount and you own the equipment outright.

Flexible End of Contract OptionsChoose between an operating lease and a finance lease. At the end of an operating lease term, you can upgrade to new technology, extend the lease, make an offer to purchase or simply return the equipment. There are no hidden clauses or residual value liability.

At the end of a finance lease term, you simply pay the agreed residual amount and you own the equipment outright. Easy UpgradeTake advantage of our upgrade option, and update equipment when required. It’s a great way of maintaining cash flow while financing your ongoing business needs.

Easy UpgradeTake advantage of our upgrade option, and update equipment when required. It’s a great way of maintaining cash flow while financing your ongoing business needs.